America's Charities | March 25, 2020

Employers Consider Hardship Assistance in Response to COVID-19, Seek Guidance from America’s Charities

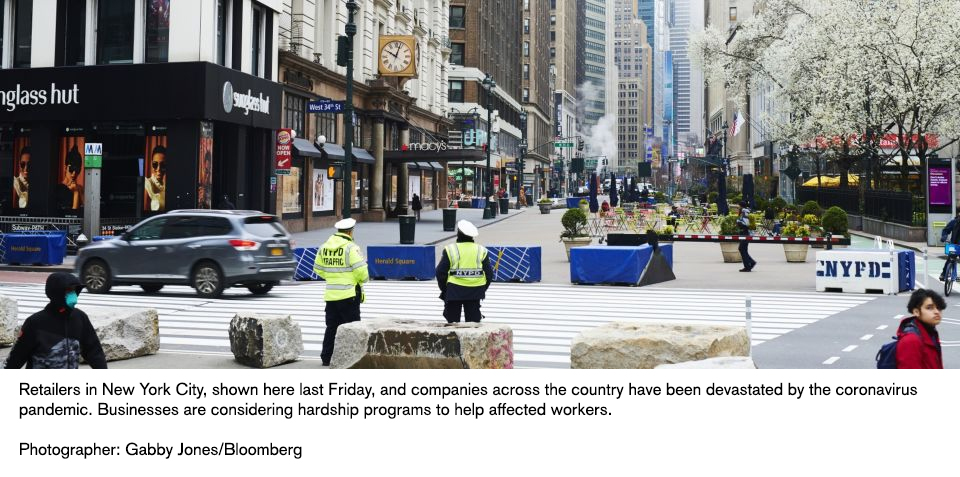

While the full brunt of the coronavirus still hasn’t smacked the U.S. economy, employers are already examining tax-advantaged hardship assistance programs to support workers facing significant health and financial challenges due to the emergency.

In this article from Bloomberg Tax, Staff Correspondent, Michael J. Bologna reports how employers are examining tax-advantaged hardship assistance programs to support workers facing significant health and financial challenges due to the emergency, and America’s Charities President and CEO Jim Starr shares how employers for looking at creating crisis funds as a way to make tax-deductible donations and permit employees to collect emergency grants tax-free.

Get Resources and Insights Straight To Your Inbox

Explore More Articles

America’s Charities Named ‘Best Nonprofit To Work For’ For Fifth Consecutive Year

Washington, D.C. – April 1, 2025 – America’s Charities, the nonprofit that mobilizes the power of giving as a leading provider of volunteering, workplace giving,…

Get Resources and Insights Straight To Your Inbox

Receive our monthly/bi-monthly newsletter filled with information about causes, nonprofit impact, and topics important for corporate social responsibility and employee engagement professionals, including disaster response, workplace giving, matching gifts, employee assistance funds, volunteering, scholarship award program management, grantmaking, and other philanthropic initiatives.